The running gold: Romania’s hydropower sector

.jpg)

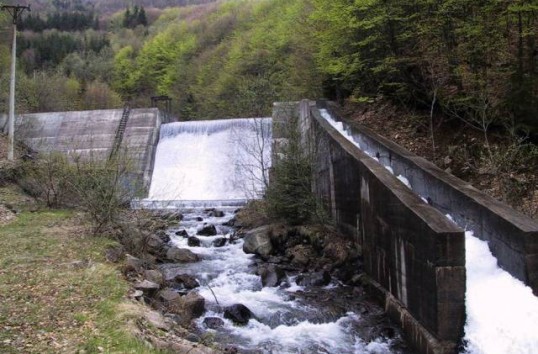

Harnessing hydropower energy is the best alternative for the development of Romania’s energy sector. An alternative which has been neglected, since no new major projects have been carried out over the past years, as investments have been restricted to the completion of some old projects, such as Racovita Hydroelectric Power Plant whose construction works started 24 years ago.

According to the official data concerning Romania’s hydropower potential – some 40 TW per year in the hydropower energy sector and 6 TW in the small hydropower energy field – barely half of this potential is used. Even so, hydropower remains a major source of electricity, accounting for about 30 percent of the total power produced within the country.

Hidroelectrica ‘runs’ the waters

Hidroelectrica is the major player in the market, both considering power produced in hydroelectric stations, as well as the small hydropower plants (SHPs) – the state-owned company having over 150 SHPs in its portfolio.

While investments in new hydroelectric power stations have remained only under discussion, Hidroelectrica intends to get rid of more than half of the SHPs it owns. Thereby, last year Hidroelectrica announced there will be put up for sale 88 SHPs which are inefficient, requiring refurbishment processes.

‘Through

the strategy approved, Hidroelectrica aims to sell within 2013-2014 period a

total of 88 small hydropower plants, accounting for less than 1 percent of the

total power installed, due to recording, each year, operating and maintenance

costs significantly higher than the revenue they generate and the company does

not have resources to support the necessary investments in order to ensure

profitability by obtaining green certificates.’, Mihail Stanculescu, President of Hidroelectrica’s Board of

Directors, said.

‘Through

the strategy approved, Hidroelectrica aims to sell within 2013-2014 period a

total of 88 small hydropower plants, accounting for less than 1 percent of the

total power installed, due to recording, each year, operating and maintenance

costs significantly higher than the revenue they generate and the company does

not have resources to support the necessary investments in order to ensure

profitability by obtaining green certificates.’, Mihail Stanculescu, President of Hidroelectrica’s Board of

Directors, said.

Within the first selling phase, Hidroelectrica sold through an auction, held last June, 14 SHPs with a total installed capacity of 9.4 MW at a price of approximately 10 million euro. The auction for a second package of 12 SHPs was scheduled for January, this year, Hidroelectrica selling only three stations, according to Capital.

The low interest may be considered unexpected, given that those SHPs which need refurbishment services have not been affected by the Government’s decision on reducing the support scheme for green energy producers and that has recently come into force. Hence, for each MW produced in a refurbished SHP, a producer still gets two green certificates, a decision favorable to Hidroelectrica since a possible reduction of the certificates quota for this segment would have had a negative impact on the company’s sale.

On the other hand, Hidroelectrica’s reference project, which is ongoing, remains the Tarnita-Lapustesti hydroelectric power station located in Cluj County – a project started during the Communism period and that is forecasted to be fully completed by the second half of 2020. The investment for the 1000 MW to be installed comes to about 1.2 billion euro (without VAT), Hidroelectrica being the main beneficiary, as well as the main sponsor of the project. In the attempt to attract other investors so as to support its development, the company has appointed a consortium consisting of Deloitte Consulting, as Project Manager, along with Zhongnan HydroChina and BCR.

Hydro energy, less interesting than solar and wind power

Although water is commonly considered a renewable resource, when it comes to green energy from hydrological sources, it is about energy produced in hydropower plants which have an installed capacity of maximum 10 MW, included – unlike Romania, in Europe, this category does not include 10 MW power plants, but only those with a capacity below this level. A separation in this respect needs to be done given the support scheme including green certificates from which those producing green energy benefit.

While the past year proved to be excellent to Romania’s renewable energy sector in terms of development – the production of energy from green sources actually boosted, the total installed capacity reaching almost 4.300 MW, nearly double compared with 2012 when the installed capacity of all renewable energy facilities slightly exceeded 2.300 MW – 2014 comes with fewer promises for this sector.

It is mainly due to the latest, yet expected, decision concerning the reduction of the green certificates quota effective as from the beginning of this year which affects the wind, solar and hydropower energy producers. The PV sector which showed the most impressive development last year suffers the most drastic decrease (3 green certificates instead of 6), followed by the wind energy sector (1.5 instead of 2) and by the hydropower energy one, considering that a reduction (2.3 green certificates instead of 3) is applied only on new small hydropower plants, those refurbished benefitting from the same support scheme.

In Romania, the total installed capacity in small hydropower plants at the end of 2013 amounted to 530 MW, over the past years seeing an advance in terms of projects developed in this sector. However, the progress is far more limited than that recorded by others fields of renewable energy. And that despite of an estimated power potential of 6 TW in the small hydropower field, according to the data available in the National Renewable Energy Action Plan.

Small Hydropower Plants projects, whereto?

Romania is considered to be a proper region, given the

geographical and meteorological conditions, for producing energy using

renewable sources such as wind, solar or hydro. Whilst the wind energy and the

PV sectors show a significant progress, representing the main sources of power production,

the hydro energy field has seen a slow advance despite its great potential. One

or maybe the main reason is probably the cost involved when investing in a

hydropower station which is considerably higher than that needed for completing

a wind or solar plant.

Romania is considered to be a proper region, given the

geographical and meteorological conditions, for producing energy using

renewable sources such as wind, solar or hydro. Whilst the wind energy and the

PV sectors show a significant progress, representing the main sources of power production,

the hydro energy field has seen a slow advance despite its great potential. One

or maybe the main reason is probably the cost involved when investing in a

hydropower station which is considerably higher than that needed for completing

a wind or solar plant.

Besides that, such a project is far more complex, needing an extended period of time for its completion. So, according to ANRE’s estimations, whilst 1MW installed in a wind power plant generates a cost of some 1.4 million euro, for same power capacity installed in a SHC, an investor will spend about two times more. Yet, the same ANRE data shows that except biomass cogeneration plants, SHPs have the highest capacity factor of the other power plants using green sources.

On the other hand, the legislative sphere is quite challenging, putting a barrier to the development of this sector. Regulations in Romania are hazy, unclear and lack stability – aspects all investors are looking for when thinking about starting such a project.

’There are challenges arising from various directions, but the lack of certainty and legislative instability considerably affect investments. Authorizing projects is complex and difficult, legislative provisions in this sector are intricate, sometimes contradictory and are implemented differently from a region of the country to another.’, according to Anca Velicu, Attorney at Law, within Schoenherr law firm.

An eloquent example, the latest one, is the fact that Traian Basescu sent back to the Parliament for a review the law with respect to the support scheme for renewable energy producers for. The said law sustains the Government Decision no. 57/2013 regarding the temporary reduction until 2017 and 2018, respectively, (1 GC/ MW for new small hydropower stations, 2 GCs/MW for solar plants – to be recovered as from April 1, 2017, as well as 1GC/MW for wind power plants – effective until December 31, 2017.) of the quota of green certificates allocated to green energy producers. Thereby, so as Govnet has previously explained, until the law in question will eventually come into force, the new producers entering the renewable energy market this year are drastically affected from both the definitive reduction of the support scheme effective as from January 1, 2014 and the temporary cutback of green certificates quota.

A worrying situation with a negative impact on investments in this field, as Monica Cojocaru, Partner with Schoenherr law firm explains: ‘The legislative instability has significantly braked the development of renewable energy projects in 2013. We expect a recovery once the law approving and amending the Ordinance no.57 will be passed by the Parliament and promulgated by the President, thus ending legislative inconsistencies and uncertainties. All these, however, probably will not happen before the end of March, 2014.’

Besides these, another critical aspect to consider is the environment. After numerous cases of hydropower projects infringing environmental regulations, a greater concern in respect to this issue arose amidst the authorities, resulting into a new hindrance in the development of SHP projects.

So, based on a protocol concluded between the Department for Waters and Forests inside of the Ministry of Environment and World Wide Fund for Nature foundation, there will be defined some exclusion and some unfavorable and less favorable areas to the construction of small hydropower plants. The issue is that starting the current month and until those areas will be established – the deadline is May 31, 2014 – all approvals and permits for setting up small hydropower and hydroelectriced stations in protected areas are suspended.

Despite all these issues, Romania’s hydropower sector could drive the development of the energy field, provided waters eventually calmed down. For instance, small hydropower plants could be a viable solution for supplying power to rural areas which are not connected to the electricity grid. A solution and an opportunity for investors who are keen on developing such projects which would lead to an increased use of the hydro energy potential and which will be reflected both into the electricity price, as well as into a less polluted environment.