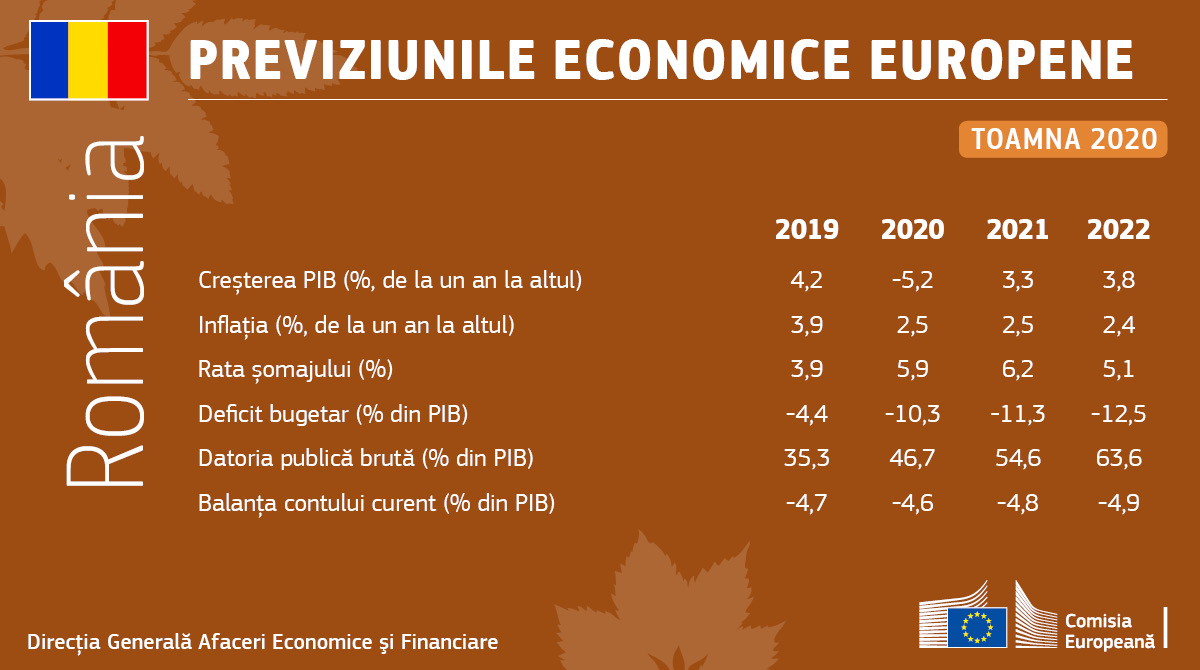

The European Commission's forecasts show a decrease in Romania's GDP by 5.2% in 2020 and an increase of approximately 3.3% in 2021 and 3.8% in 2022

Although the contraction of Romania's economy in 2020 appears less severe than initially expected, uncertainty remains very high given the recent evolution of the pandemic and real output is not set to return to pre- crisis levels before the end of 2022 shows the report issued by the European Commission.

The budget deficit is projected to increase significantly, as the fiscal effort required to fight the crisis comes on top of past fiscal slippages. Real GDP fell by 4.5% year-on-year in the first half of 2020. Strict lockdown measures had a negative impact on consumer spending. In addition, the disruption of international supply chains and weak external demand slowed production and exports. As the import decline was somewhat less strong, the trade balance continued to deteriorate, but improved primary and secondary income balances lowered the current account deficit. Investment surprised with a positive contribution to growth as construction activity was largely unaffected by containment measures. Romaniaʼs economy continues to be affected by COVID-19 as some restrictions have been reintroduced in the autumn, and the resulting uncertainty is set to dampen economic growth, particularly in the fourth quarter of 2020.

Recovery expected to be gradual

Real GDP is forecast to contract by 5.2 % in 2020 and to rebound by around 3.3% in 2021 and 3.8 % in 2022. Private consumption should recover gradually, in line with the eventual easing of social distancing measures, in 2021 and 2022. Investment is also projected to rebound, albeit somewhat muted due to spare capacity and persistent uncertainty. Net exports are expected to contribute negatively to growth in 2020. After a sharp contraction in April, exports began improving in the third quarter of 2020, but losses are not expected to be recovered by year-end. As domestic demand declines, imports are also set to fall, albeit less than exports. Exports are expected to pick up as of 2021 supported by the gradual recovery of global trade, while import growth is set to resume, reflecting increased consumer spending. Overall, the contribution of net exports to growth over the forecast horizon is set to remain negative. The current account deficit is expected to decline in 2020 only slightly compared to 2019 and increase again in 2021 and 2022. The unemployment rate increased in the first half of 2020 but stabilised over the summer, due to policy measures limiting job losses. It is projected to reach almost 6% in 2020 and continue increasing somewhat in 2021 due to a delayed downturn reaction of the labour market. In 2022 unemployment is expected to decline again but stay above 5%. Nominal wages are projected to increase moderately over the forecast horizon after several years of double-digit growth. In response to the COVID-19 crisis, the National Bank of Romania cut its key monetary policy rate in three steps from 2.5% to 1.5% and purchased more than RON 5 billion worth of government securities on the secondary market between April and August to support the financing of the real economy and the public sector. Inflation is projected to fall to 2.5% in 2020 mainly due to the sharp fall in oil prices and is set to remain contained throughout 2021 and 2022.

Risks to the growth forecast

Prolonged uncertainty related to the future direction of public policies in Romania could reduce confidence and hamper credit flows, negatively affecting investment and growth. A smaller than envisaged increase in pensions would not necessarily translate into heightened risks for growth thanks to positive confidence effects generated by the improved fiscal outlook. On the other hand, the funds allocated to Romania under the Recovery and Resilience Facility are expected to provide further support to investment.

Public deficit on an increasing path

The general government deficit is forecast to increase to around 101⁄4 % of GDP in 2020, from 4.3% in 2019. The pre-existing expansionary trend largely driven by pension increases is set to be reinforced by the impact of the COVID-19 crisis. Expenditure on old-age pensions is set to rise considerably, driven by the full-year effect of a 15% pension increase from September 2019 and a further increase of 40% from September 2020. Moreover, the child allowance has been doubled. Additional spending due to COVID-19 related measures, including employment support schemes and health-related spending, is projected at 1.3 pps. of GDP, out of which 0.4 pps. financed by EU transfers. Tax revenues are set to be negatively affected by the recession.

Despite an economic recovery forecast and the expected expiry of pandemic-relief employment support schemes (in the absence of the 2021 budget), the general government deficit is set to increase further, to around 11.3 % of GDP in 2021 and 12.5 % of GDP in 2022 under a no-policy- change assumption. This is due to the full-year effect of the 40% increase in pensions from September 2020, and an additional upward pension recalculation scheduled for September 2021. This forecast does not include any measures funded by Recovery and Resilience Facility grants. As a consequence, Romania’s debt-to-GDP ratio is forecast to rise from 35.3% in 2019 to around 63.5 % in 2022. An upside risk to the general government balance projections is that the increases in pensions and child allowances could turn out to be more moderate.

The government in the budget amendment of August proposed to increase pensions by 14% instead of 40% from September 2020 and to stagger the increase in child allowances over time. However, the parliament rejected this proposal. This forecast, in line with the standard no-policy change assumption, follows the parliamentary vote. Going forward, in the absence of a 2021 budget, it incorporates the increases mandated by the pension law currently in force.