Deloitte analysis: record number of M&A deals in 2021, estimations for unprecedentedly intense activity in the coming years

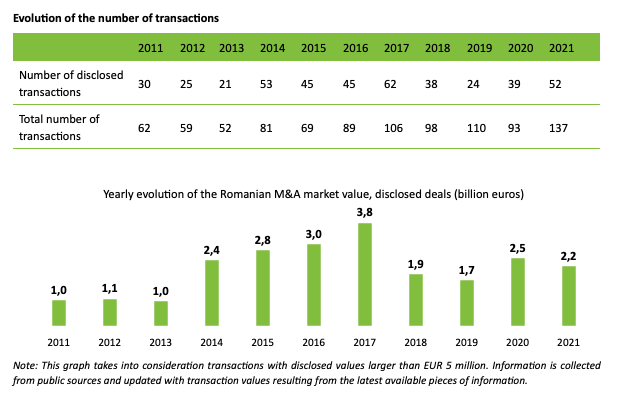

Romania’s mergers and acquisitions (M&A) market reached an all-time record in 2021 in terms of number of deals, having recorded 137 transactions, according to an analysis conducted by Deloitte Romania. The estimated total market value for both disclosed and undisclosed transactions reached around EUR 4-4.4 billion, while the value of disclosed transactions amounted to EUR 2.3 billion. In comparison, transaction market value in 2020 was EUR 3.9-4.1 billion and EUR 2.5 billion, respectively.

“The pandemic has catalysed M&A activity across its entire spectrum, on the one hand reshaping both traditional and non-traditional businesses, while also triggering generalized macroeconomic stimulus. Global M&A activity reached record levels in 2021. In Romania we are seeing very good years for the local M&A market in 2021, as well as 2020. Our analysis suggests the positive dynamic is here to stay, thus we anticipate unprecedented M&A activity in the coming years,” said Iulia Bratu, Corporate Finance Director, Deloitte Romania.

Five transactions with a disclosed or estimated value of minimum EUR 100 million were announced in 2021.

“In 2021, the local businesses’ interest in getting listed on the stock market through initial public offerings and in attracting financing via the stock exchange was significantly higher compared to prior years. It is also worth mentioning that the number of transactions with values over EUR 5 million involving private equity, either on the sale or buy side, has increased during the last year and reached 24. Another notable fact is that local private equity firms increased their investments during 2021, indicating clear signs of maturity of the local market. Considering how 2021 has evolved compared to last years, how the regional and global M&A market has developed in 2021, and what the transactions pipeline look like at this point in time, 2022 will be a promising year from an M&A perspective. I believe that Romania will continue to be on the investors’ radar,” stated Radu Dumitrescu, Financial Advisory Partner-in-charge, Deloitte Romania.

The largest deals of 2021 were:

- Romanian majority state-owned Romgazhas reached an agreement to acquire a 50% stake in Neptun Deep, the offshore gas field project in the Black Sea, from US-based ExxonMobilfor a disclosed value of EUR 920 million and completion of the transaction is expected in the first quarter of 2022;

- London-based Novalpina Capital acquired MaxBet Romania for an estimated value of EUR 250 million;

- Glovo’s acquisition of Delivery Hero operations in the Balkan region for a disclosed value of EUR 170 million;

- the Hungarian private equity fund Adventum bought Hermes Business Campus from Atenor, a transaction estimated at EUR 150 million;

- Hidroelectrica’s takeover of Crucea Wind Farm and Steag Energie for a disclosed value of EUR 130 million.

The most active sectors by volume of transactions were real estate (including construction), technology, energy and industry. Together, they generated 76 transactions. From a deal value point of view, the most active sector was real estate, followed by energy and retail & distribution.

The Romanian M&A market in 2021

- market value (disclosed transactions): EUR 2.3 billion;

- estimated market value (including undisclosed transactions): EUR 4-4.4 billion;

- number of transactions with disclosed value: 52;

- average deal value (calculated for disclosed transactions): EUR 27 million.